Excess line insurance must be countersigned by an authorized agent in order to be valid. This requirement is imposed by law in most states, and it serves to protect policyholders by ensuring that they are dealing with a licensed and reputable insurance company.

In this article, we will discuss the legal requirements for countersignatures on excess line insurance policies, as well as the role of the countersigning agent.

Countersignatures are required on excess line insurance policies because these policies are not issued by admitted insurers. Admitted insurers are insurance companies that have been approved by the state insurance department to sell insurance in that state. Excess line insurers, on the other hand, are not admitted insurers.

They are typically insurance companies that are domiciled in other states or countries, and they are not subject to the same regulations as admitted insurers.

Excess Line Insurance Countersignatures

Excess line insurance countersignatures are a legal requirement in many states. They serve to ensure that excess line policies are issued in compliance with state regulations and that the policyholder is aware of the risks involved.

Legal Requirements

The legal implications of excess line insurance countersignatures vary from state to state. In some states, countersignatures are required for all excess line policies, while in others they are only required for certain types of policies. The specific regulations governing countersignatures can be found in the insurance code of each state.

- California:Excess line insurance policies must be countersigned by a licensed surplus line broker.

- Florida:Excess line insurance policies must be countersigned by a licensed surplus line agent.

- Texas:Excess line insurance policies must be countersigned by a licensed surplus line insurer.

Agent Responsibilities

The countersigning agent is responsible for ensuring that the excess line policy is issued in compliance with state regulations. This includes verifying that the policyholder has a legitimate need for excess line coverage and that the policy is not being used to avoid state insurance regulations.

The countersigning agent is also responsible for providing the policyholder with a copy of the policy and a notice of the risks involved in purchasing excess line insurance.The duties and liabilities associated with countersigning excess line policies can be significant.

The countersigning agent may be held liable for any damages that result from the issuance of an invalid or unenforceable policy.

Excess Line Brokers, Excess line insurance must be countersigned by

Excess line brokers are often used to place excess line insurance policies. Excess line brokers are licensed insurance professionals who have the expertise to help policyholders find the right coverage for their needs. Excess line brokers can also help policyholders to understand the risks involved in purchasing excess line insurance.There

are a number of benefits to using an excess line broker to countersign an excess line policy. Excess line brokers can help policyholders to:

- Find the right coverage for their needs.

- Understand the risks involved in purchasing excess line insurance.

- Avoid costly mistakes.

However, there are also some challenges to using an excess line broker. Excess line brokers may charge a fee for their services, and they may not always be able to find the best coverage for policyholders.

Countersignature Procedures

The countersignature process for excess line insurance is typically straightforward. The policyholder first applies for coverage through an excess line broker. The excess line broker then submits the application to an excess line insurer. If the insurer approves the application, the policy is issued and countersigned by the countersigning agent.The

following documents are typically required for the countersignature process:

- Application for excess line insurance

- Policy

- Notice of the risks involved in purchasing excess line insurance

The countersigning agent must keep a record of all countersigned policies for at least five years.

Impact on Policy Coverage

Countersignatures are an important part of the excess line insurance process. They help to ensure that excess line policies are issued in compliance with state regulations and that the policyholder is aware of the risks involved. Without a countersignature, an excess line policy may be invalid or unenforceable.The

following are some of the potential consequences of failing to properly countersign an excess line policy:

- The policy may be invalid.

- The policy may be unenforceable.

- The policyholder may be liable for damages.

It is important to note that countersignatures do not guarantee that an excess line policy will be valid or enforceable. The policyholder is still responsible for ensuring that the policy is issued in compliance with state regulations and that the policy meets their needs.

FAQ: Excess Line Insurance Must Be Countersigned By

What is excess line insurance?

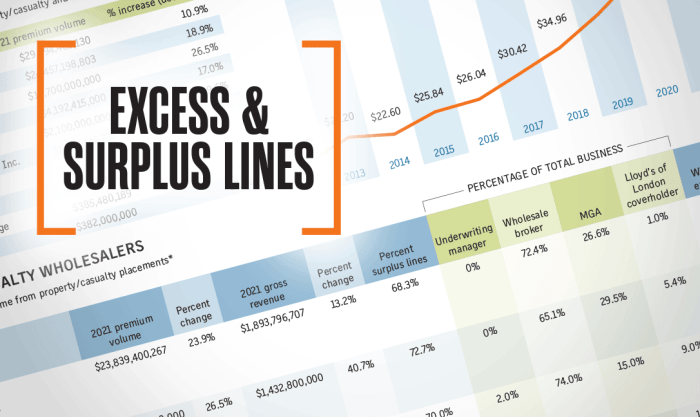

Excess line insurance is insurance that is placed with an insurer that is not admitted to do business in the state where the policyholder is located.

Why is a countersignature required on an excess line insurance policy?

A countersignature is required on an excess line insurance policy to ensure that the policy has been placed with an authorized insurer and that the policyholder is dealing with a licensed and reputable insurance agent.

Who can countersign an excess line insurance policy?

An excess line insurance policy can only be countersigned by an authorized insurance agent.